The Global Financial Crisis: A Decade Later

The Bloom Economic Research Division serves as a core research division within Bloom leading an open-source data approach to credit analysis. The BERD team conducts and publishes policy and economic research with the goal of leading a discussion towards a healthy global credit climate. BERD’s mission is to open source our learnings, research, and interviews to create a more inclusive, global, and personal credit system.

Ten years ago, the sudden and shocking collapse of investment bank Lehman Brothers sent shockwaves reverberating through the financial, economic, and political world. Since then, citizens, academics, and policymakers have been wandering through the rubble, slowly trying to put the pieces back together.

On the ten-year anniversary of the Global Financial Crisis, we take a look back at its labyrinthine pathologies and wide-ranging consequences.

The Blind Spot

In August of 2005, Raghuram Rajan, chief economist at the International Monetary Fund, stepped in front of the world’s top finance ministers and central bankers at the Federal Reserve Bank of Kansas City’s annual economic retreat in Jackson Hole, Wyoming and gave a startling speech that no one was expecting, nor particularly keen, on hearing. Rajan spoke of acute systemic risk in the global financial system, of savings and pensions being plunged into risky, opaque, and overly complex financial instruments, and, as a result, of a potentially severe banking crisis looming on the horizon.

The response from the gathering of the world’s elite economists was not one of alarm or consternation, but rather of gleeful mockery and swift marginalization of Rajan’s “stone age” thinking. After all, it was then Chairman of the Federal Reserve, Alan Greenspan himself, who said in 2004 that “not only have individual financial institutions become less vulnerable to shocks from underlying risk factors, but also the financial system as a whole has become more resilient.” Among top economists, systemic risk in the global financial system was not the primary cause for concern, it was a growing Chinese-American macroeconomic imbalance that posed the greatest risk to the US economy.

China’s holdings of US Treasuries had grown precipitously just as Americans were becoming increasingly wary of rising public debt, stoking fears of a Chinese sell-off and invoking the specter of a “sovereign debt crisis.” Larry Summers described the Sino-American dynamic as a “balance of financial terror.” This myopic focus on China’s growing financial claims on America created a glaring blind spot for economists, politicians, and policymakers that would have devastating consequences when the global credit bubble burst in late 2008.

On the Precipice of Collapse

On March 16, 2008, in what would be the first domino to fall in the worst banking crisis and economic downturn since the Great Depression, flailing Wall Street investment bank Bear Stearns agreed to a late-night fire sale to JPMorgan Chase after having been pushed to the brink of bankruptcy. Liquidity and capital pressures quickly started mounting for top investment banks as defaults on the underlying mortgages in their securities portfolios surged, confidence in mortgage-backed securities and collateralized debt obligations flagged, and losses in the private mortgage-backed securities market mounted.

Just six months later, in the very early morning of September 15, 2008, Lehman Brothers filed for bankruptcy. Lehman’s collapse immediately triggered money markets to seize up, with global interbank markets following suit and freezing within a matter of weeks. Liquidity in the global financial system dried up. Dollar funding, with a shortage that ran into the trillions, became a scarce and precious resource. Credit tightened. Uncertainty spread around the globe. As the world would soon find out, Lehman’s death spiral would mark the dawn of unprecedented intervention by governments and central banks across the world as its effects rippled out to the Eurozone and then on to emerging markets.

The following day, the Financial Times declared September 15, 2008 as the “day of reckoning on Wall Street.” Merrill Lynch, exposed to massive losses from its CDO portfolio, was sold off in a fire sale to Bank of America. Insurance giant AIG was desperately in need of a bailout, quickly receiving $85 billion from the Fed. Panic spread like wildfire. It was reported that Morgan Stanley and Wachovia would need rescuing. And soon confidence in retail banks began to waver. The solvency of Citi and Washington Mutual would also soon be put into doubt, with more bailouts following shortly thereafter. On September 18, Treasury Secretary Hank Paulson and Fed Chairman Ben Bernanke presented Congress with a $700 billion bailout plan to staunch the bleeding and prevent all-out collapse, with TARP eventually passing in October.

Economists were stunned. Politicians were outraged. Customers feared they wouldn’t be able to withdraw cash from ATMs, all the while trying to wrap their heads around the intricate workings of a financial system that was seemingly falling apart by the hour. Bankers themselves were shell-shocked. The months that followed the failure of Lehman were defined by an apocalyptic tone of the imminent collapse of the world economy, with politicians and commentators openly discussing how close to the precipice of all-out calamity the global financial system really was. As economist Ann Pettifor would later write, “The world was perilously close to complete financial breakdown.”

Quickly, it became clear how absurdly overleveraged commercial and investment banks really were, with extreme liquidity mismatches as they lent long and borrowed short. Debt-to-equity leverage ratios for the top Wall Street investment banks reached as high as 33-to-1. Propelled by the belief that markets were efficient, actors rational, and that housing prices would rise indefinitely, bank balance sheets skyrocketed and greedy and risky behavior took root as short-term profits and bonuses became the name of the game. Of course, banks weren’t the only ones overleveraged, US households also faced high debt burdens, with many homeowners dipping into negative equity as housing prices plummeted.

The Run-Up

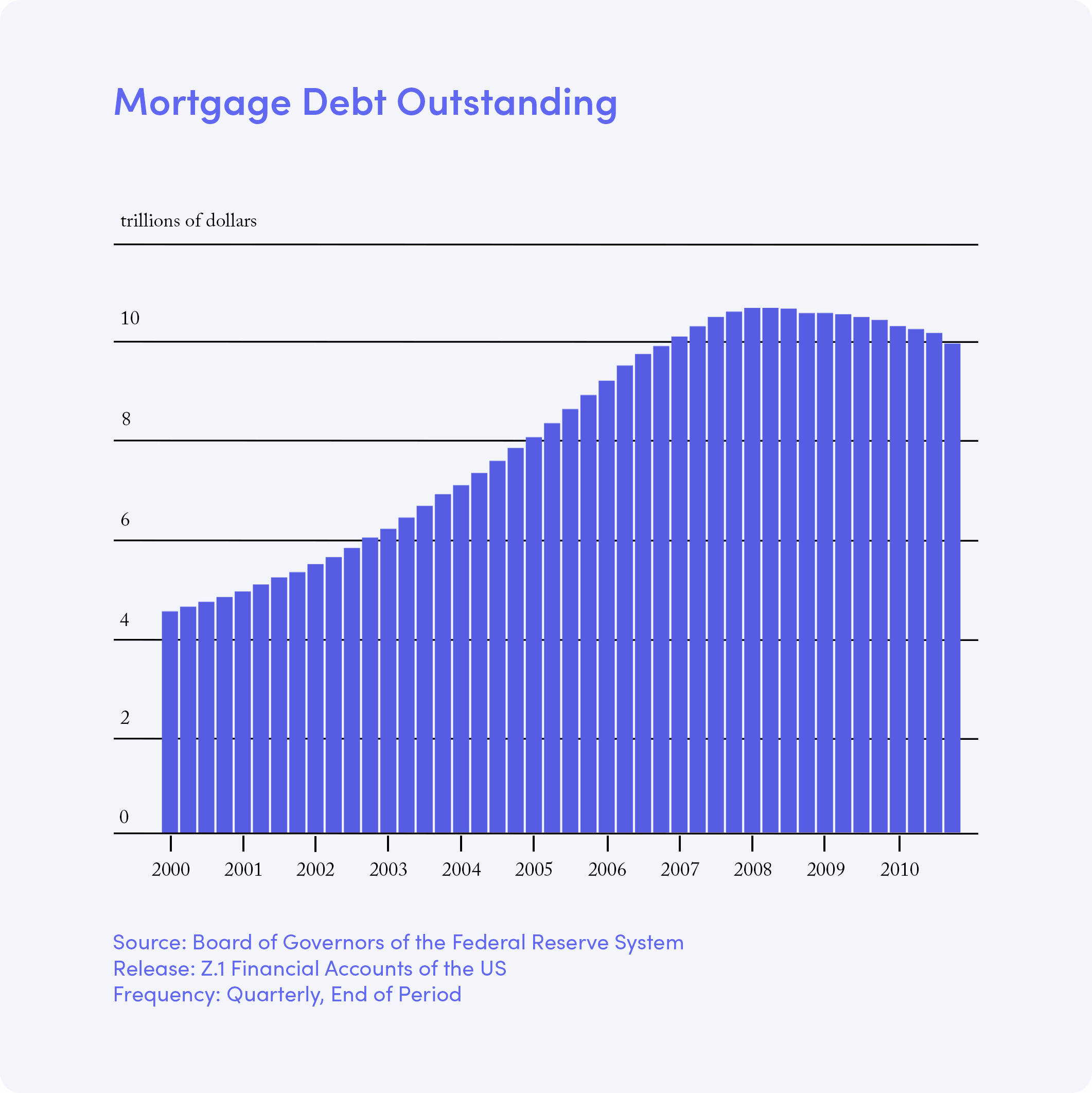

Pre-crisis, aggregate debt was soaring. Household, government, financial, and corporate debt rose precipitously from 2000 to 2008. Cross-border capital flows reached 438 percent of global GDP in 2007, as mobile capital flowed freely around the globe in search of returns and global capital markets drove asset price bubbles in markets around the world. Of course, the rise of globalized finance in the 2000s also gave rise to rapidly diverging incomes and wealth, as profits flowed to the top. Bankers and financiers became the robber barons of the new millennium, reaping vast sums of money on Wall Street and in the City of London as housing prices and bank profits soared.

In the heat of the early 2000’s, in the run-up to the crisis, mortgage lenders, brokers, and non-bank originators went in search of as many borrowers they could find, regardless of ability to repay, and then sold mortgages on to investment banks who then pooled, or securitized, both prime and subprime mortgages into mortgage-backed securities that the glut of global savings could invest in for a greater return than the yields on government bonds could provide. As savings went in search of higher returns, commercial banks, investment banks, and specialty lenders rushed into the void to provide and buy all kinds of extremely risky and complex securities to satiate demand from their investors.

Once the government-sponsored enterprises, Fannie Mae and Freddie Mac, had bought or guaranteed as many conforming mortgages as they could, private mortgage securitization ramped up. Banks put together special investment vehicles so they could manage assets off balance sheet, funding them by way of repos, asset-backed commercial paper, and other short-term borrowing. Special investment vehicles were used to hold structured financial instruments such as collateralized debt obligations and mortgage-backed securities, with the bank earning the rate spread between the assets and the short-term debt that funded them. It was these SIVs that collapsed when borrowers began defaulting on the underlying mortgage loans in droves as their adjustable rates started ratcheting up and investors and funding pulled out.

Along with securitization, credit growth and increasing leverage, risk was pushed up by low central bank policy rates put in place to fuel continued economic growth. Unregulated credit creation in both the commercial and shadow banking sectors greased the wheels of growth. Adjustable, subprime, and “no-documentation” mortgages proliferated. As such, reckless underwriting practices, fraudulent lending, and irresponsible funding strategies set the stage for what was to come. Liar Loans, mortgage originations that required no or low documentation that resulted from negligent and fraudulent lending behavior, went on to cause more than $345 billion in financial losses.

The Crisis Response

As the credit and asset price bubble burst and the financial system seized up, central banks jumped into action, backstopping the financial system as lenders of last resort in ways that had never before been seen. The Fed led the charge, going so far as to establish liquidity swap lines with central banks around the world to provide dollars to those short on them, pumping trillions into European central banks, cutting interest rates at home, and infusing the financial system with liquidity by buying up government bonds and mortgage backed securities in what would come to be known as Quantitative Easing.

From 2008 to 2014, the Fed expanded its balance sheet from $880 billion to over $4.5 trillion. Over half of the Fed’s liquidity support went to banks overseas. Meanwhile, the Bank of England purchased £375 billion worth of UK gilts from the private sector within a nine-month period in 2009. As monetary authorities eased conditions, governments were quick to turn fiscal policy towards the disciplinarian hand of austerity, punishing citizens by gutting discretionary public spending at the same time they were propping up financial institutions with trillions of dollars of liquidity.

European politicians, policymakers, and commentators were quick to frame the crisis as a truly American phenomenon, the result of a special kind of American capitalist novelty, but as crisis spread to Western Europe, the vast scope, depth, and entanglement of transatlantic finance was put on full display. European banks were deeply exposed, stemming from deep ties to the mortgage boom in the US and asset price bubbles elsewhere across Europe, their balance sheets just as bloated as their American counterparts. As money poured into US Treasuries as the ultimate safe haven asset, and the dollar appreciated, dollar-denominated debt in Europe, especially in the east, became increasingly hard to repay.

Fiscal conservatives went about pinning responsibility for the crisis on out-of-control government spending and reckless consumer borrowing. Fiscal consolidation went on to become the policy doctrine of politicians worldwide as the crisis in transatlantic finance spread to the Eurozone. The protracted Eurozone crisis from 2009 onwards hit Greece, Ireland, Portugal, and Spain especially hard, with extremely over-indebted banks and nearly insolvent governments threatening further collapse in the European banking system while being further squeezed by austerity measures coming down from the troika of the European Central Bank, European Commission, and International Monetary Fund.

The Fallout

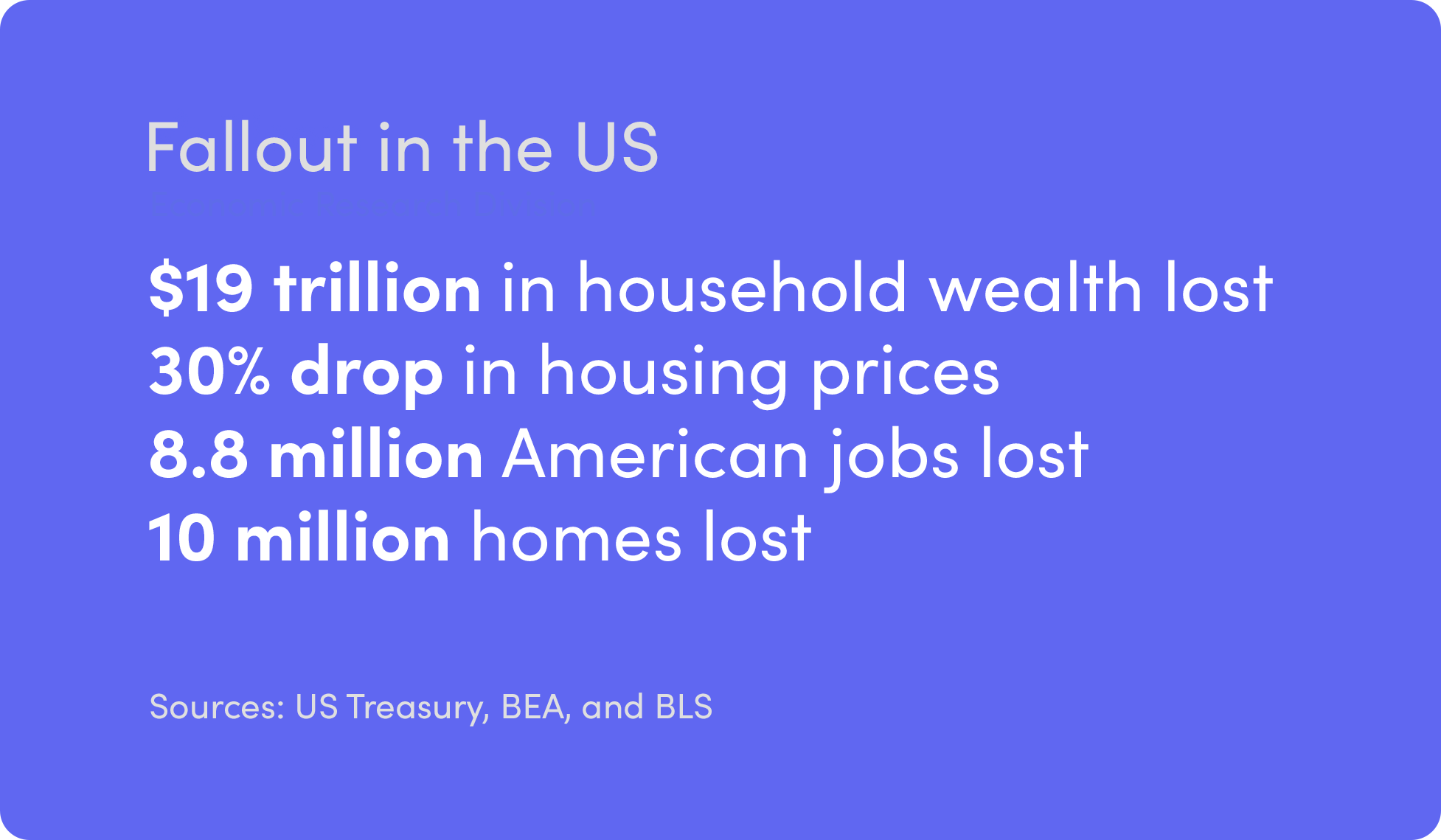

In the wake of the crisis, homeowners were left to face default and foreclosure as unemployment soared and borrowers worked desperately to keep their heads above water. Bankers and asset managers were, of course, protected, while everyday Americans, Europeans, and citizens across the world shouldered the brunt of the fallout, nearly singlehandedly bearing the pain, suffering, and grief that ensued. Within the span of just two years, $19 trillion of US household wealth was wiped out, more than 8.8 million American lost their jobs, and unemployment soared to as high as 10%. Housing prices cratered, gutting wealth for the middle-class. Nearly 10 million Americans lost their homes.

In Europe, unemployment hit 27.9% in Greece, 26.5% in Spain, and 11% overall in the European Union in 2013. Unemployment in Ireland climbed to a peak of 14.8% as its economy locked-up and the country dovetailed into a deep economic recession. Property values collapsed. Hundreds of thousands of protestors took to the streets in Ireland as the Occupy movement spread from Wall Street to Dublin. In Greece, the downturn cut so deep that some commentators went so far as label it a humanitarian crisis as social welfare programs were gutted in what would come to be known as the “Greek Depression.” Greece would go on to suffer the longest economic recession in history.

Default and foreclosure would inflict losses of $500 billion in the private MBS market by 2012. Ten years later, no truly fundamental change has come the global financial system. The Basel Committee post-crisis reforms brought about small adjustments rather than sweeping structural changes. As such, banks have decreased leverage, become beholden to greater capital requirements, adjusted the risk weighting of assets, and faced more stringent regulation. Macroprudential tools such as stress testing on the national level, and through regulatory frameworks such as G-SIFI on the global level, have been put into place.

Quantitative easing may have stabilized the financial system but its effects of propping up specific asset prices and inflating others, assets which are primarily owned by the wealthy, have increased economic inequality instead of reducing it. Corporations in the US have continued to increase leverage, making both household and corporate debtors a risk to the financial system. Over-leverage, weak demand, and deflationary pressures across advanced economies around the world all present problems moving forward, generating the potential for a calamitous feedback loop as extreme indebtedness weakens demand and leads to disinflation, further increasing the real value of debt.

A Decade Later

Aggregate demand in economies around the world is still beholden to debt-fueled consumption. Household debt is back on the rise. Total global debt-to-GDP is at historical highs. Rising interest rates could quickly make that debt unaffordable, as borrowers are forced to refinance and the dollar strengthens. Rate hikes, and the strengthening of the dollar, are hitting emerging markets hard, increasing the real burden of dollar denominated debt. Mortgage fraud is once again on the rise. Interest rates hovering near the zero lower bound in the US, Eurozone, and Japan will make central banks less effective in battling the next downturn.

Employment has become more precarious in nature in the US, UK, and other developed nations over the past decade. According to the McKinsey Global Institute, global debt has grown by $57 trillion since 2007, with the worldwide debt overhang growing from 269% of global GDP in 2007 to 286% in 2014, with leverage increasing in every single advanced economy. China is in the midst of an unprecedented credit boom, racking up household and corporate debt at an unprecedented pace. As the global lower and middle classes continue to struggle, wealthy households have amassed over $5 trillion of wealth in offshore tax havens. Global growth is forecast to slow, with the catch-line “secular stagnation” gaining steam in academic and financial circles. Income inequality has skyrocketed around the world.

As the next downturn looms on the horizon, only time will tell whether the global financial system is stronger and more resilient than before and what form the political economic response will take this time around.

More from BERD

- Report: A New Credit Paradigm in China

- Report: The Student Debt Crisis

- Read our Credit Conversations