Bloom Integrates with Chainlink to Bridge the Gap Between Traditional and Decentralized Finance

This month, Bloom announced the first live integration between traditional credit bureaus and decentralized finance. Within the Bloom app, users can leverage their data as the basis for a reusable, decentralized Verifiable Credential that demonstrates their creditworthiness.

By integrating with Chainlink, Bloom is expanding the potential usage of this Verifiable Credential feature by making it available to DeFi applications.

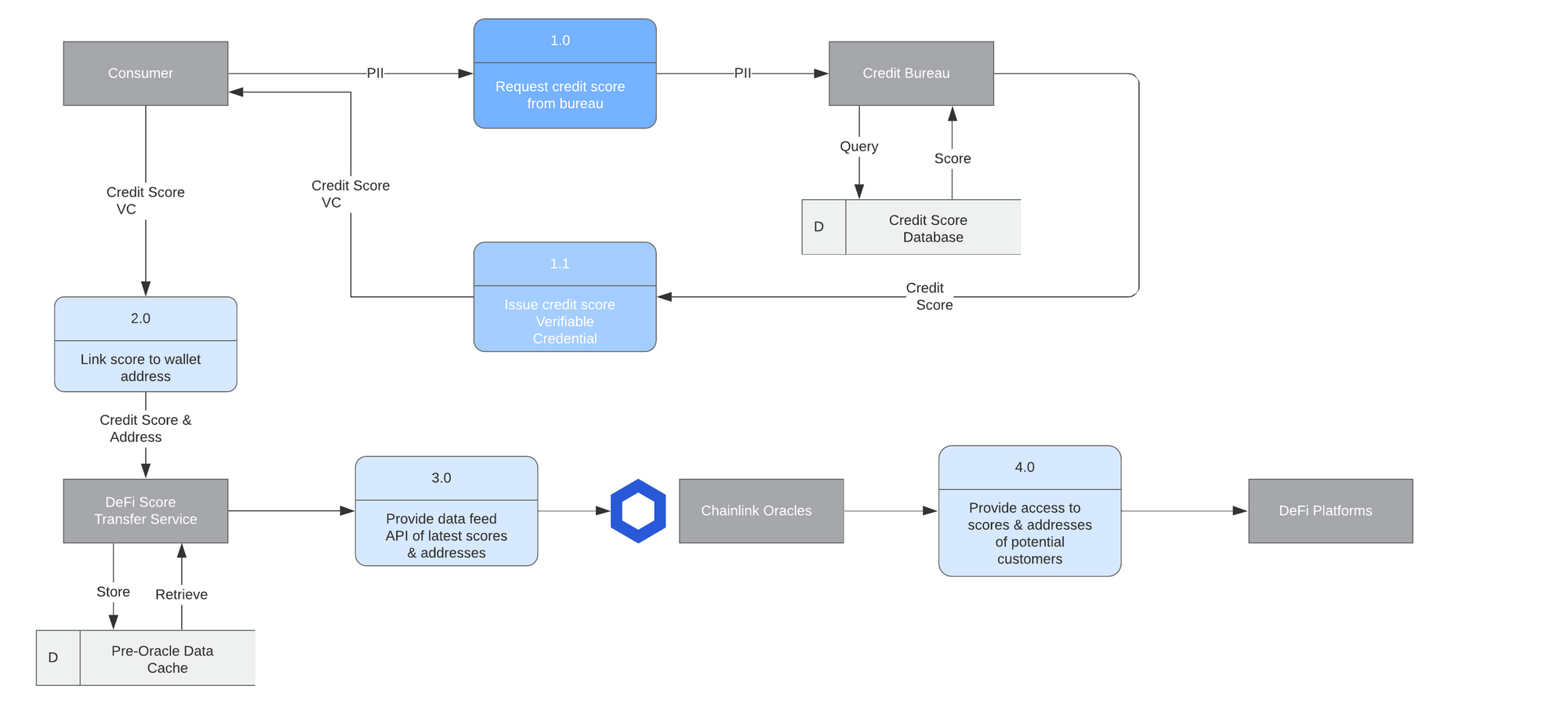

Chainlink, a decentralized oracle network, acts as a secure and reliable bridge that allows Bloom’s off-chain Verifiable Credentials to be referenced to by on-chain DeFi lending marketplaces. Users share their credit report credentials with a score transfer service hosted by Bloom. Bloom extracts anonymized creditworthiness data and associates it with an Ethereum address provided by the user. This address and creditworthiness data pair is cached until it is transmitted on-chain by a decentralized network of Chainlink oracles, which use computational redundancy to ensure the oracle’s security. The data is then available to be consumed by any on-chain lending marketplace, such as for accreditation, credit history, and more.

Expanding the Market for DeFi Lending

In the DeFi space, consumers already have access to over-collateralized loans via platforms like Maker or flash-loans that provide temporary liquidity via Aave. However, no one has been able to launch an on-chain unsecured lending product because they are missing a fundamental layer for sourcing identity and creditworthiness. One option would be to slowly build up a credit profile on each platform by taking out secured loans, but this is very time consuming, inefficient, and difficult to scale.

Bloom's integration with Chainlink fast tracks the ability to create unsecured loans on DeFi infrastructure by allowing Dapps to access existing, portable credit profiles. Thus, DeFi can tap into traditional credit histories, which have been carefully cultivated and trusted by traditional finance for decades, in order to quickly and securely launch new undercollateralized lending products. This greatly expands the DeFi lending market and allows for more efficient capital allocation based on lower collateralization rates.

Beyond the Bureaus

Bloom is also tackling the challenge of DeFi credit aggregators. We will soon share more details on our generic Verifiable Credential aggregator which takes the place of traditional credit bureaus. Users select their own aggregator and control exactly how much they see, where the data is stored, and how to use it.

Bloom is transforming global identity and credit through a decentralized infrastructure that is private, secure, financially inclusive, and consumer controlled. Founded in 2017, nearly a million people have created a self-sovereign identity with Bloom.

With 15+ data partnerships and users in almost every country, Bloom has deployed the only live end-to-end infrastructure covering DID creation, Verifiable Credential issuance, scaling, selective sharing, data partnerships, decentralized design, and real-world integrations critical to success in a live environment.

About Chainlink

If you’re a developer and want to connect your smart contract to existing data and infrastructure outside the underlying blockchain, reach out to Chainlink here! Chainlink can help you quickly and securely launch your data-enabled application and/or Chainlink Price Reference Data Contract on mainnet today. You can also visit the developer documentation or join the technical discussion on Discord. Learn more by visiting the Chainlink website or follow them on Twitter or Reddit.

Chainlink is a decentralized oracle network that enables smart contracts to securely access off-chain data feeds, web APIs, and traditional bank payments. It is well known for providing highly secure and reliable oracles to large enterprises (Google, Oracle, and SWIFT) and leading smart contract development teams such as Polkadot/Substrate, Synthetix, Loopring, Aave, OpenLaw, Conflux, and many others.

Learn More

Verifiable Credentials

Verifiable Credentials are a core component of the decentralized identity space. An institution can issue a VC to a user, containing some assertion about the user's identity. The user can share the VC with any third party, without the third party needing to retrieve information from the original issuer.

This paradigm shift in digital identity management disintermediates centralized information brokers and gives control back to end users.

This same architecture can be used to transmit any claim about an individual to an on-chain market, with the individual's consent. These claims can indicate KYC screening, citizenship, or any arbitrary reputation score.

Read more about the emerging standards around Verifiable Credentials with the W3C and the Decentralized Identity Foundation.

Bloom Mobile App

Bloom 2 brings free credit monitoring, data breach monitoring, and enhanced smart identity features to nearly 1 million Bloom users. Now, you have the power to build a secure digital identity, check your credit score and monitor your credit all in one simple app.

Our vision is for the Bloom mobile app to be the center of your identity experience, a one stop command center for managing your identity and credit, empowering you to take back control of your data and protect your identity.

Learn more about the new Bloom mobile app.